The Rizq Factor: Building the Wealth of Muslim Women

Written by Nausheena Hussain; originally published on Reviving the Islamic Sisterhood for Empowerment (RISE)

“If you don’t know where you’re going, you might end up someplace else.” —Yogi Berra

This quote is one of the first things I read as I picked up a $3 bargain book called The Latte Factor at one of my favorite places, Half Price Books. This New York Times Best Seller has drawn many critiques: it’s written by rich white men, portraying financially illiterate women. But it’s done in a storytelling narrative that drew me in to learn more about how to build wealth, with easy, small action steps I can take to get started.

Now, before I get into those steps, I did some research to better understand why there is a narrative around women not being financially empowered and why we are economically disadvantaged. I came across an article in Ellevest called, “Just Buy the F*** Latte” by Sallie Krawcheck. Oh the irony! Krawcheck bites back at male financial “gurus” by laying out myths fed to women about money that impact their savings, wealth building and financial freedoms, including:

-

Girls aren’t good at math. So we end up staying away from anything to do with finances.

-

Boys should invest and take risks, but girls should save and rely on safety nets.

-

The financial advice that women receive is often dismissive and patronizing.

-

And this one is very common: It’s taboo to earn more than your man. Financially independent women are a threat to the patriarchy. So we are socialized, encouraged and expected to remain dependent on our male counterparts.

Now, if those myths weren’t enough, women face tremendous financial barriers. Look at these gendered inequalities surrounding money:

-

The Pink Tax - Any product marketed to women is up-charged and more expensive than products specifically designed for men.

-

The Wage Gap - White women earn $0.77 to the dollar that a man makes, and for BIPOC women, that gap is even wider.

-

The Debt Gap, the Funding Gap, and the Investing Gap - Whether she’s trying to get a loan for her business or seek out venture capital, she is denied because she is seen as too risky or unprofitable. And her dreams of pursuing entrepreneurship die.

And if she is earning in a job, she may be confronted with workplace sexual harassment or gendered violence.

With all these barriers stacked against us, don’t you wonder how to breakthrough?

I started thinking about what wealth is and how it is defined. I thought about the story of the Prophet Muhammed’s ﷺ father and grandfather. During their time, wealth was measured by the number of camels/livestock you owned, how many children you had—specifically sons—and how much gold you possessed. For my parents' generation, wealth was still defined by gold but started to shift to owning your own house and other belongings as well as being educated and raising educated children.

So, based on these measures of wealth, do I feel wealthy? I realized for me, wealth also includes my health, happiness, family, friends, and the luxury of not having to worry about money. I had the education that got me the corporate job to earn the money to buy the house and the gold. And I was grateful I wasn’t in debt, I paid off my school loans, I am healthy, I have a wonderful husband and partner, my kids are growing up safe and sound, and I’m surrounded by some of the best friends anyone could ask for. We are all richer than we think. And we need to build our wealth.

In Islam, we are taught about a concept called “rizq.” Rizq is from Allah — one of the beautiful names of Allah ﷻ is Ar-Razzaq; The Provider, The Providence, The Supplier, The Bestower of Sustenance. The One who creates all means of nourishment and subsistence. The One who provides everything that is needed.

Allah ﷻ also reminds us that the rizq we have—no matter how much we feel we might have "earned" it—is not from ourselves but has been ultimately provided by Allah ﷻ. We are grateful for these provisions and blessings. And then the Prophet ﷺ also said, “Tie your camel and place your trust in Allah” (Tirmidhi), meaning that we should nurture, grow, and increase the provisions we have received.

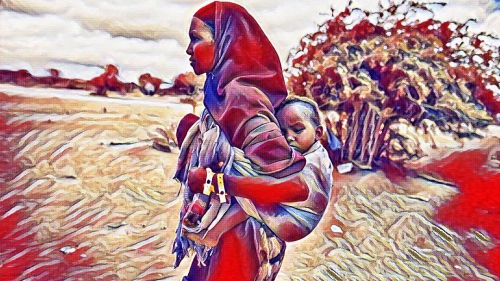

The Shari’ah, Islamic law, stipulates that women inherit wealth left behind by family members. Women inherited properties, houses, and other assets. Women not only had access to wealth, but they also had agency over how to spend it. According to K. Abdur-Rashid’s report, “Financing Kindness as a Society: The Rise & Fall of Islamic Philanthropic Institutions,” two hundred years after the death of Prophet Muhammad ﷺ, charitable foundations and endowments, awqaf, were created as financial mechanisms to support the infrastructure of the Muslim community. Records in Ankara, Turkey report over 26,000 awqaf established by the Ottomon Muslims—of which 1,400 were run by Muslim women. Women didn’t wait around for men to solve their problems but took matters into their own hands by using their own wealth to establish awqaf to meet the needs of their Muslim sisters and the broader community. Women also established ribaats, or safe housing for safety, security, companionship, community, and spiritual growth. Dr. Tamara Gray, the founder and Executive Director of Rabata, shared with me, “There was a culture of managing our own money and investing it” provided by Islamic law and upheld in the Islamic economy.

Now, before you get ahead of yourself, it's not just about making money to make more money. We are changing our mindset from scarcity to abundance. In an abundance mindset, focus on what you currently have. Take inventory and also be grateful for the many blessings that Allah ﷻ has bestowed upon you. Turn your thoughts around to show gratitude and appreciation. Dream of possibilities. Imagine what you can do with just a small amount of savings when you invest into a dream. Let’s change our money habits from saving to investing in long-term solutions for generations to come. We're not trying to win the lottery, or inherit someone’s large estate, or strike oil/gold.

Allah ﷻ gave us agency over our money 1,400 years ago so that we were our own safety nets. Listen up sisters: it is not enough to rely on him. It’s time to take stock and assess your own financial status.

Take a moment to reflect or write about what you are doing with your life. In the next five years, what do you want to do?

Dream big. Now think about what you need financially to accomplish that. How much money?

For me, I did dream big. I want to retire early and travel in first class, staying at five-star hotels, and eating at bougie restaurants with my friends! I want to have more money so I can support the causes I care about—not just with $25 Give to the Max Day donations but also with significant capital that will leave a sadaqa jariya for me. I hope one day I can walk into a Ramadan fundraiser dinner, hear that tonight's goal is to raise $150,000, and write a check and let everyone just enjoy their meal! I hope one day I can take my parents to Hajj. I hope that the house we own now is the first in building generational wealth for my future grandchildren.

I’m tying my camel and drinking my latte.