OPEC vs. Richardson: An Open Battle to Control Oil Prices

Oil producing countries appeared to be determined not to fall victim to their fragmentation and lack of accordance. That was, at least, not until the Clinton administration strongly opposed the newly adopted policy by oil exporters which calls for limiting the output of production as a reliable approach to keep prices in check. Nowadays, oil prices have soared in international markets. On February 12, crude oil on the New York Mercantile Exchange briefly jumped to $29.94 per barrel and closed later in the day at $29.44. Later on, prices thundered and unexpectedly broke the $30 dollars a barrel record, the highest price in nine years.

The astonishing performance of oil prices which comes shortly after an alarming setback, indicates a fundamental change in oil production policy, not only for OPEC members, but for non-OPEC members as well. Since all oil producers feel the negative impact of the price drop, the March 1999 agreement was an unexpected and urgently needed step on the road to re-boost the oil prices. The meeting was indeed successful. Oil producers including Norway and Mexico came out with a magic spell that has apparently achieved wonders thus far. Three jumps in oil prices were enough to bring the good old days back for oil producers, yet the fear remains.

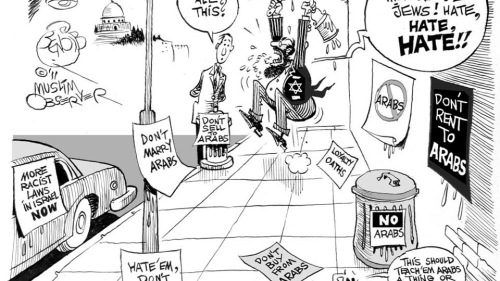

Since several oil producers rely heavily on oil revenues, additional price slides could means devastation to their fragile economic structure. While such economic vulnerability is nothing for these countries to be proud of, they should be the least credited for their ability to work together under very pressuring circumstances. Most of the pressure has come from the United States, who accuses the oil producers of hurting the growth in the world economies, especially the United States'.

Early February, a Saudi source told London-based Al-Hayat newspaper that a price level of $25-$27 a barrel reflected the market's condition, and that any higher prices would be the result of speculation in the futures market. He affirmed the fact that OPEC is carefully monitoring the market, and that there is no shortage in supplies as "some" have claimed. The "some" to which the source referred is the American administration, which strongly criticized the Saudis, their policies and their changing outlook regarding exports. Saudi Arabia, according to a larger policy, by which it must abide -- as an OPEC member and also as a sovereign nation that maintains its own economic approach -- decided to reduce crude oil deliveries to the United States. The Saudis, like other oil exporters are careful not to flood the markets with crude oil, after paying the heavy price for not maintaining relative unity in their oil exporting policy.

As one's strategic policy is another's call for disaster, U.S. Energy Secretary Bill Richardson sees the Saudi step as a manipulative tactic aimed at upsetting the already declining oil supplies in the United States. The Saudi decision was made only one day after Clinton's administration's decision to squeeze more supplies into the U.S. market. Richardson, using strong language stated, following the surprising Saudi move, "This action by the Saudis represents a firm step in the wrong direction. The US market needs more oil supplies, not less." He re-affirmed, "I urge -- in the strongest terms -- that oil producing nations recognize that the world needs more oil, not less, and needs it sooner, rather than later."

The Clinton administration, while refusing to release oil from the Strategic Petroleum Reserve to lower crude prices, has acted as if the latest shortage of supplies was a part of a comprehensive and well-constructed scheme. The Saudis think not. According to the same official Saudi source to Al-Hayat, neither oil prices nor OPEC oil supplies policy is causing inflation in the West. He attributed the decline in supplies in the U.S. markets to refineries using stored supplies instead of purchasing from the market.

As expected, the United States is gearing up for a new round of pressure to change the oil producers' recently adopted strategy of cooperation to keep oil prices at a level that will enhance their economic development.

Bill Richardson is touring several countries that are seen as the engineers of the oil production agreement of last year, and foreseen as the ones who will have the greatest impact on the anticipated Vienna summit on March 27.

Mexico was the first stop in Richardson's tour. He promoted the same message of how the oil price rise could set an environment for inflation. He brought no mention of the fact that little sympathy was offered to oil producers when their economies were brought to their knees only a few months ago as a result of uncontrolled production. The Mexican energy Minster, Luis Tellez, seems to have buckled under Richardson's pounding pressure, or at least that is how the Mexican opposition understood Tellez's promise to increase oil output to the United States starting April 1. Cuauhtemoc Cardenas, the leader of the Opposition Party of the Democratic Front (PRD) described Tellez's backing as "nothing more than a policy of submission." Richardson is also visiting the Arab Gulf states and Norway. Similar concessions are expected to be cultivated.

The important issue at stake is the challenge facing oil producers who are striving to protect their economies from unpredictable markets. Yet while many challenges can be conquered through mutual agreements and honest implementation of what has been agreed on, certain challenges are not easy to be conquered. U.S. pressure, used generously on counties like Mexico, Saudi Arabia, Venezuela and others, has proven somewhat successful. It is easy to shower Tellez with criticism for falling under Richardson's "diplomacy". But is more understandable when one considers the fact that 80 percent of the Mexican exports are directed to the United States. Like Mexico, other counties find themselves obliged not to take the American pressure lightly.

The Vienna summit should be a chance for oil producers to explore and invent new options that can protect their interests and economies from outside pressure like the pressure currently used by the Clinton administration. It is important for these countries to emerge as strong following the present quarrel of accusations. While they are urged not to jeopardize the world's economic growth, they ought to remember that protecting their delicate economies is essential behind their own growth and therefore survival.

Topics: Bill Clinton, Business, Energy Industry, Oil & Gas, Opec

Views: 1362

Related Suggestions