Lessons from Islamic and Ethical Finance for Today

The notion of the moral economy is intrinsic to all the major faiths, each of which has placed ethical boundaries on the behavior of those active in the market.

The ten commandments of the Jewish Torah or Christian Old Testament laid down an ethical boundary - or regulation - for work:

"for six days you shall labor and do all your work. But the seventh day is a Sabbath to the Lord your God; you shall not do any work - you, your son or your daughter, your male or female slave, your livestock, or the alien resident in your towns".

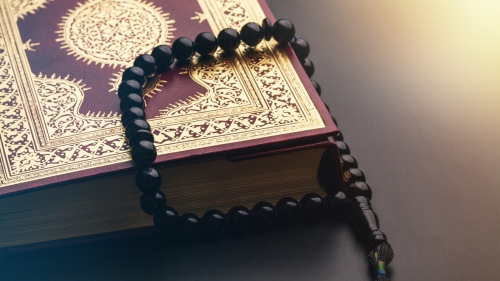

The Qu'ran lays down clear ethical boundaries for lending and borrowing, and for trade.

These boundaries have been vital in the maintenance of great civilizations. As Karl Polanyi, the great economic historian argued (in his 1944 book "The Great Transformation") - the regulation of the conduct of human affairs by law is vital to the maintenance of civilized society, and to the market, because

"robbed of the protective covering of cultural institutions, human beings would perish from the effects of social exposure; they would die as the victims of acute social dislocation through vice, perversion, crime and starvation....neighborhoods and landscapes defiled, rivers polluted, military safety jeopardized, the power to produce food and raw materials destroyed".

So one of the great contradictions we in the West face today is this: law - or regulation - needs boundaries, in particular ethical boundaries; but also geographical and political boundaries.

However markets, in particular financial markets, abhor boundaries.

How do we reconcile therefore, the ethical boundaries/regulation advocated by the world's great religions with the resistance of, in particular financial markets, to these boundaries?

That is the great challenge faced today by those who would promote the notion of a moral economy.

One of the most important ethical boundaries set by the Prophet in the Qu'ran has to do with the 'price' paid for a loan: the rate of interest. While many would regard the Qu'ran's strictures on interest rates as antiquated, I would like to argue that they are acutely relevant to today's financial crisis.

This is because one of the economic characteristics of the period from 1980 to the present day is high real rates of interest (i.e. adjusted for inflation/deflation) paid by borrowers. By this we mean interest rates in the broadest sense: those for short, long, real, risky as well as safe loans. While the Federal Funds or Bank of England rate might seem low, the real rate paid by credit card holders or entrepreneurs taking risks, has for a long period, been much, much higher.

Indeed it is these high rates of interest, that I contend, led to the 'debtonation' of the financial system in August, 2007, and the most severe financial crisis in history. For it is high real rates of interest that ultimately made debts unpayable - for sub-prime mortgage borrowers in the US, for the millions that have defaulted on their mortgages and had their homes 'foreclosed'; for thousands of companies that have been bankrupted by a heavy burden of debt; by semi-states such as Dubai, and now by states such as Iceland, Ireland and perhaps Greece.

Historically the average rate of return on investment has been in the range of 3-5%. Any borrowing above that rate presents repayment difficulties for most entrepreneurs and investors. The post 1977 rates of interest can be described as usurious.

Sidney Homer's A History of Interest Rates, has been the definitive analysis of the subject since its first edition in 1967. He published a second edition ten years later. Homer died in 1983, and his pupil Richard Sylla was entrusted with the production of a third edition of his work. On the opening page, Sylla warned:

"The spectacular rise in interest rates during the 1970s and early 1980s pushed many long-term market rates on prime credits up to levels never before approached, much less reached, in modern history. A long view, provided by this history, shows that recent peak yields were far above the highest prime long-term rates reported in the United States since 1800, in England since 1700, or in Holland since 1600. In other words, since modern capital markets came into existence, there have never been such high long-term rates as we recently have had all over the world." (Homer and Sylla, 1991, p. 1)

High rates across the whole architecture of rates - for short and long, safe and risky loans - have prevailed ever since.

Tremendous capital gains have effortlessly been made by those who held assets, lent them on to governments, corporations or individuals, and thereby extracted even greater wealth. This is what has always been understood as usury.

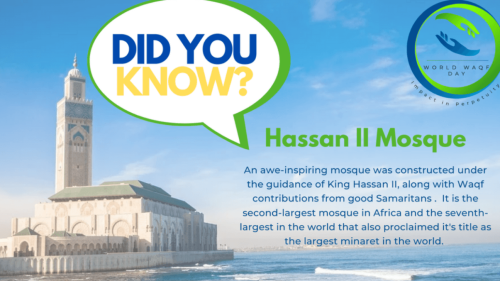

Islam and interest-bearing money

'Those who consume interest shall not rise, except as he rises whom Satan by his touch prostrates [i.e. one who is misled]; that is because they say: "Trade is like interest"; whereas, Allah [God] has permitted trading but forbidden interest. ......whosoever reverts (to devouring interest) those, they are the inhabitants of the fire, therein dwelling forever." Qu'ran 2:275

Islam prohibits the taking or giving of interest or riba, regardless of the purpose of the loan, or the rates at which interest is charged. "Riba" includes the whole concept of effortless profit or earnings that comes without work or value added production.

In Islam money can only be used for facilitating trade and commerce - a crucial difference with the world's major Christian religions. This was because Islamic scholars were fully aware that debt-creating money can stratify wealth, and exacerbate exploitation, oppression and the enslavement of those who do not own assets.

The Qur'anic ban on interest does not imply that capital or savings are without cost in an Islamic system. While Islam recognizes capital as a factor of production, it does not allow capital to make a claim on the productive surplus in the form of interest. Instead Islam views profit-sharing as permissible, and a viable alternative. The owner of capital can legitimately share in the gains made by the entrepreneur. That implies that the owner of capital will also share in the losses.

Investors in the Islamic order have no right to demand a fixed rate of return. No one is entitled to any addition to the principal sum if he does not share in the risks involved. Another legitimate mode of financing recognized in Islam is based on equity participation (musharaka) in which partners use their capital jointly to generate a surplus. Profits or losses are shared between partners depending on the equity ratio.

Islamic banking is a risky business compared with conventional banking, for risk-sharing forms the very basis of all Islamic financial transactions.

Global finance, in the shape of un-regulated and unethical capitalism, poses a profound threat to Islam. Because Islam expressly prohibits the concentration of wealth in the hands of the few, i.e. hoarding (kenz) waste (tabthir) extravagant consumption (israf) and miserliness (bukhl) - the excesses of global financial liberalization are in deep conflict with Muslim values.

Not only Muslim values, but the values of Jews and Christians too.

If we are to return to our roots; if we are to protect both our civilization, but also our ecosystem, then it is vital that we, as people of faith, once again assert the centrality to society of the moral economy.

*****

Ann Pettifor is a fellow of the new economics foundation (nef) and co-author of 'The Green New Deal'. In 2009 she was named one of the Ecologist magazine's 'visionaries'. She lectures widely on international finance and sovereign debt; and on the need to devise new economic policies to deal with the 'triple crunch' of the financial crisis; peak oil and climate change. She is also executive director of Advocacy International Ltd.

Source: ToddsMurray.com

Topics: Economy, Interest (Riba), Islamic Finance Values: Trustworthiness

Views: 12954

Related Suggestions

Muslims seem to not distinguish between interest and usury. You do seem to refer to it earlier in the article but then later say all interest is prohibited. Usurious interest rates are designed to impoverish the borrower and it is this that the Qur'an is strictly prohibiting and not, as many seem to contend, charging interest for cost of money and profit.

In most societies, including many Muslim societies, it is the practice of charging usurious rates by rich landowners that serves as a means of keeping the great majority of farmers impoverished. Usury is employed to maintain economic slavery. It is this that the Qur'an is strongly condemning.

The misapplication of riba to cover ALL interest leads to two negative issues. 1. Without any benefit to the borrower there is little incentive to lend so most of the money sits idle and not working to improve society. 2. Many muslims to borrow and lend money and while they are doing nothing wrong they are feeling guilty because they are told it is wrong, making their iman weaker.

It is most unfortunate that even today we are not looking at this issue with ALL of the Quranic statements taken collectively. Finally, ALL the injunctions in the Qur'an are directed at the lender and none at the borrower. The borrower has potential for being exploited and the lender is being strongly cautioned not to exploit. How this has been twisted to say it is a equal sin to borrow or lend is really problematic. How can the exploiter and the exploited be considered as both commiting the same sin? There is no support from the Qur'an for the belief the borrower is commiting a sin when paying interest.

He is criticizing them for saying the EXACT THING HE IS SAYING !! It

appears to me you are sore about a different article than this one as

you say "Once again you have....."etc.

So now I am Very 'interest'ed to know this- what type of doctorate do

you hold???

people; bad assumption. Where there is money, there is greed and

fraud; and muslims are no exception.

Discussion of Ethical Islamic Finance is oxymoron. Sorry, religion

cannot be of any help (and I mean any and all religions). All waste of

time. Get real folks. In the real world, we are all hypocrites.

Muslims did not descend from Heavens; they are from planet earth and

cannot be different in this respect than from other people.

Understanding the rulings on basis and scope of forbidden interest would have to include the sayings and practice of the Prophet of Islam. Taken together any fair mind would understand that interest in all its shape and forms a forbidden in Islam (and that includes, definitely, Bank

Interest)

Once again, the usual assumptions (Taqlid) are being peddled with little proper due diligence being applied.