Islamic Finance appeal growing in face of credit crisis

The global credit crisis presents the $1 trillion Islamic finance industry with an opportunity to expand its appeal beyond Muslim investors, as a haven from speculative excess.

The message may have particular resonance in the West after the crumbling of the U.S. mortgage market left banks holding hundreds of billions of dollars of nearly worthless credit instruments tied to home loans by a web of complex structures.

While conventional banks worldwide are nursing losses of more than $400 billion from the credit crisis, Islamic banks are virtually unscathed. And they are playing up the contrast to scalded shareholders, bondholders and borrowers and fearful depositors.

"It's very much a return to old-fashioned conservative lending," said David Testa, chief executive of Gatehouse Bank, which began operations in April as the fifth Islamic bank in Britain.

"The current global market condition has given Islamic finance a great opportunity to show what it can do - help to fill the liquidity gap," he said.

Investors traumatized by the credit crisis could seek comfort from the stricter rules imposed on lending by Islamic law, which bans some of the structures and financing methods that quickly unraveled during the U.S. mortgage crisis.

Testa said that Islamic finance practices were more fiscally conservative, with direct participation by investors in plans that do not involve parking assets in off-balance-sheet vehicles.

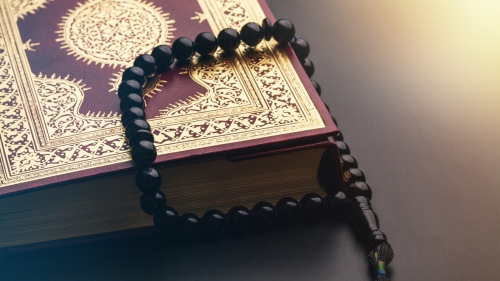

Islamic finance is based on Shariah, or Islamic law. It requires that gains be derived from ethical and socially responsible investments and discourages interest-based banking and investments in sectors like pork, gambling and pornography.

The Asian Development Bank estimates that Islamic assets globally have a combined value of about $1 trillion, with annual growth of 10 percent to 15 percent a year. Al-Rajhi Bank of Saudi Arabia and Kuwait Finance House are the two biggest Islamic banks in the Gulf region. In Malaysia, the largest Islamic lender is Maybank Islamic, a subsidiary of Malayan Banking.

The jump in popularity of Islamic finance is drawing the interest of companies outside the Middle East.

City Developments, one of the largest developers in Southeast Asia, said last week that it could issue Islamic debt and sell hotels to enhance its ability to make acquisitions.

The Islamic finance industry, which was nearly nonexistent 30 years ago, has certain distinguishing features that make it less risky, analysts say.

Islamic bonds, or sukuk, replace coupons with payments backed by the performance of tangible assets. Islamic law prohibits the payment of interest and requires transactions to be linked to assets, thus deterring the kind of complexities prevalent in conventional financing operations.

Debashis Dey, the Dubai-based head of capital markets at the law firm Clifford Chance, said that although the Islamic finance industry was adapting conventional products to make them compliant with Shariah, it was a long way from sophisticated products like collateralized debt obligations.

But while Islamic products are coming into favor, analysts say market commentators and intermediaries may be too zealous in promoting the merits of Islamic finance as a safe product.

Mohamed Damak of Standard & Poor's cited the case of the boom in real estate financing in the Gulf mainly by Islamic banks in the past three years, amid soaring property prices.

"A correction of the real estate sector would impact Islamic banks involved in this business line. Islamic finance is not immune from risk," he said.

Even as experts are weighing the degree of insularity that Islamic financing provides, there are differences in the way accounts are prepared and in how Shariah law is interpreted.

Banks in Britain differ in their accounting operations from banks in Bahrain, for example, which in turn differ from banks in Malaysia and Indonesia.

Dey, at Clifford Chance, said the lack of standardization posed a hurdle to growth, but others said that a cookie-cutter approach was not desirable and that regional differences would remain.

"Complete standardization may not happen - there will always be variants," said Raj Maiden, managing director at Five Pillars in Singapore, who added that it was more important to tailor products according to the needs of each market.

While the debate rages on whether Islamic finance provides a safer bet or is merely a potential source of irrational exuberance, most agree the industry should make the most of the attention it is now receiving.

"If Islamic banks step up to the mark, then they will gain traction," said Testa, of Gatehouse.

Source: International Herald Tribune

Related Suggestions

To do islamic finance, there has to be islamic "money". Does any country has that?

Salaamu alaykum

"What is Biblical Christianity?"

I have never heard of a Biblical Christian Bank as we always hear of Islamic Banks. The Quran clearly prohibits interest taking and giving. Is this also the message of the Bible? While many Muslims stay away from interest based banking, is this also true in the case of Christians?

Also a comment on the Islamic banking:

Muslims do not go to Islamic finance because they are safe, give higher return or cost less but because of their desire to follow the Commandment of God as revealed in the Quran. In many cases it costs more, has less return and is more risky.

Aziz Huq

Eating Halal meat is regarded as foreign while people enjoy eating pork a source of so many diseases not less than 70 including roundworm tapeworm that could cause memory loss blindness and damage in the liver. Gambling is another thing which is prohibited by Islam but because people enjoy getting money without hard labour this is why it is stil prevalent in the west. As

time goes the truth is coming to light and baatil is disappearing.In sha Allah one day the whole humanity would realise the importance of what Islam has been telling us unfortunately one cannot grasp unless and until he or she has hidayah guidance which we should all pray for before it is too late when our eyes close i.e after death.

Assalamu alaikum

The bottom line is no Usury. The Quran and the hadith have made is clear what is allowed and what is forbidden. It is a big sin to makeup thinks (bida). The Sharia must be follow with no deviation. May Allah protect us. (Subhanallah)

Al-Baqara (The Cow)

2:278 O you who have attained to faith! Remain conscious of God. and give up all outstanding gains from Usury, if you are [truly] believers; [266]

2:275 THOSE who gorge themselves on Usury [262] behave but as he might behave whom Satan has confounded with his touch; for they say, "Buying and selling is but a kind of [263] Usury" - the while God has made buying and selling lawful and Usury unlawful. Hence, whoever becomes aware of his Sustainer's admonition, [264] and thereupon desists [from Usury], may keep his past gains, and it will be for God to judge him; but as for those who return to it -they are destined for the fire, therein to abide!

It is haram to deal with riba (interest) in any way. That means that if you take out a loan and they say if you don't pay it back by a certain time, there will be interest, it is then haram for you because you could die and that debt will be your family's responsibility and they will have to deal with riba. Both you and your family will then be in the wrong and will have to answer to Allah for that on Yomo Qiyamma.

We must stay away from the forbidden and anything unclear.

Lets not forget that the U.S economic history is laden with thievery,SLAVERY, HARAM RIBA(interest),broken treaty after treaty etc!!!!!

IT HAS FINALLY CAUGHT UP WITH THEM AND IT WILL BE UGLY!

"Got HIJIRAH"